Get Up To $250 From Starbucks†#

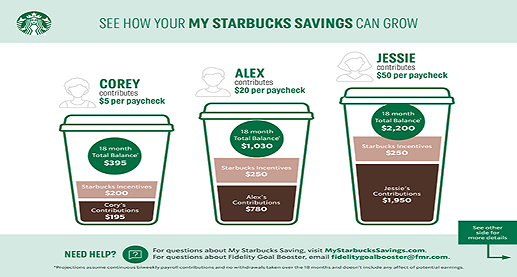

My Starbucks Savings is an exciting way partners can prepare for the unexpected with help from Starbucks. As part of our commitment to your financial well-being, we want to help you nurture your financial growth. Starbucks will deposit up to $250 to your account when you reach certain milestones. Incentives are subject to eligibility requirements and federal income tax withholding.

How To Earn Incentives

| When you … | Starbucks will give you … | Timing* |

|---|---|---|

| Set a goal, open an account and deduct at least $5 from each Starbucks paycheck | $50** | The month after you open your account and set your payroll deductions |

| Continue saving towards your goal(s) from each paycheck for a full quarter, plus have at least $50 saved in or across your goal account(s) at the end of the quarter | $25 per quarter*** ($150 maximum total contribution) | After the end of each calendar quarter |

| Reach a total balance of $400 for the goal(s) you save for out of your paycheck at the end of any month | $50**** | The month after you end the month with an account balance of $400 or more |

Who’s Eligible

While any Starbucks partner 18 or older can set a goal and save through payroll deductions with Goal Booster, the My Starbucks Savings incentives are only available if you:

- Have reached 90 days of continuous employment and

- Are not in a role at the director level or above

In addition, you must be actively employed on the last day of the incentive month and have an open account with an active Goal Booster election on the date the incentive is deposited to your account. Inactive or closed accounts cannot accept deposits.

For eligibility requirements and plan terms, review the Benefits Plan Description on the Benefits page of the Partner Hub. If there is any discrepancy between the information set out in this post and the plan provisions, the terms of the plan provisions will govern. Starbucks presently intends to continue these plans but reserves the right to change, modify or terminate the plans at any time and with or without notice and for any reason.

Even if you are ineligible for incentives you still may elect to open an account through Goal Booster and fund the account through payroll deductions.

Log in to Fidelity Goal Booster using a Fidelity.com ID or your NetBenefits ID and password. If you do not have a NetBenefits account yet, select the button below to set it up. View step-by-step instructions for setting up a new account here if you get stuck.

What Next?

Set Up Your Account

Ready to go? Set a goal, open an account and set your payroll deductions to start earning incentives.

Get Answers

Still have questions? Read the FAQ for all the details on My Starbucks Savings.

Questions?

For questions about the My Starbucks Saving program, review the FAQs.

For questions about Fidelity Goal Booster email goalbooster@fidelity.com.

*My Starbucks Savings incentives are typically added to your goal account mid-month after you’ve met the requirement. If you have multiple goals, only one account will receive the reward.

**$50 credit for opening account requires continual payroll deductions (i.e., setup a $5 per paycheck deduction that is continuous during the qualifying time period). Partners need to be actively employed at the end of the qualifying time period. The $50 incentive will generally be deposited by the 15th of the month following the month in which the criteria is satisfied. This is a one-time incentive per eligible partner.

***$25 quarterly incentive requires maintaining a minimum balance of $50 at the end of each quarter and ongoing regular payroll deductions of at least $5 per paycheck throughout the quarter. Incentive will generally be deposited by the 15th of the month following the end of the calendar quarter in which the criteria is satisfied. Currently a maximum of $150 in total quarterly incentives is available.

****$50 one-time incentive when your account balance is at least $400 at the end of a qualifying month.